Guiding Principles

1. Maintain New York City's financial responsibility

2. Advance a more equitable New York City

3. Build a climate-ready New York City

4. Promote forward-looking, holistic capital planning

5. Incorporate community perspectives in capital planning and decision-making

Guiding Principle 4:

Promote forward-looking, holistic capital planning

The City accounts for neighborhood and citywide growth trends, including current and projected population, housing, and employment. While each agency has its capital planning process, we also ensure that we consider the totality of neighborhood needs over time and integrate these needs into our capital planning accordingly. We also consider capital investments in the context of other policy, regulatory, and expense budget measures to improve the quality of life across the City.

Planning for change

City agencies consider citywide and neighborhood trends in population, housing needs, and job growth when planning for capital investments to address future needs. The City also continues to evaluate the demographic shifts related to the COVID-19 pandemic. Understanding these shifting trends, along with climate change, is key to developing near- and long- term capital plans that can meet the needs of each neighborhood and the City. (For more detail on our planning for climate change, see Guiding Principle 3.) By planning with consistent, accurate data, we aim to provide all New Yorkers with the appropriate level of capital investment for their current and future needs.

Planning for changes in population

Agencies use DCP’s projections on population changes to plan capital projects that will meet the evolving needs of communities. The most recent long-term projections estimate that New York City’s overall population will increase to roughly nine million by 2030, with significant growth in Brooklyn, Queens, and the Bronx. Having these projections at the borough and neighborhood level helps agencies know where to prioritize their capital investments today. For example, FDNY uses both population projections and housing growth data to determine neighborhood investments for fire safety infrastructure and emergency services. Current population projections for fast-growing neighborhoods can be seen in the call-out box below.

While population projections reflect known development trends and demographic characteristics that remain relatively consistent over time, there are limits on the ability to predict changes caused by other factors, such as changing economic or social conditions. The most recent population projections were created before the COVID-19 pandemic and before both the 2020 Census and the Census Bureau’s 2021 population estimates. The 2021 population estimate showed a substantial decline starting in 2020, largely because of heightened losses via net-domestic migration occurring in the earliest part of the pandemic. These losses were unforeseen, but the 2020 Census count of 8.8 million exceeded earlier projections. These countervailing demographic inputs cumulatively resulted in minor changes to our near and long-term population growth projections. Additional insights and refreshed projections are expected after the Census Bureau publishes 2020 Census age-sex datasets, in May of 2023.

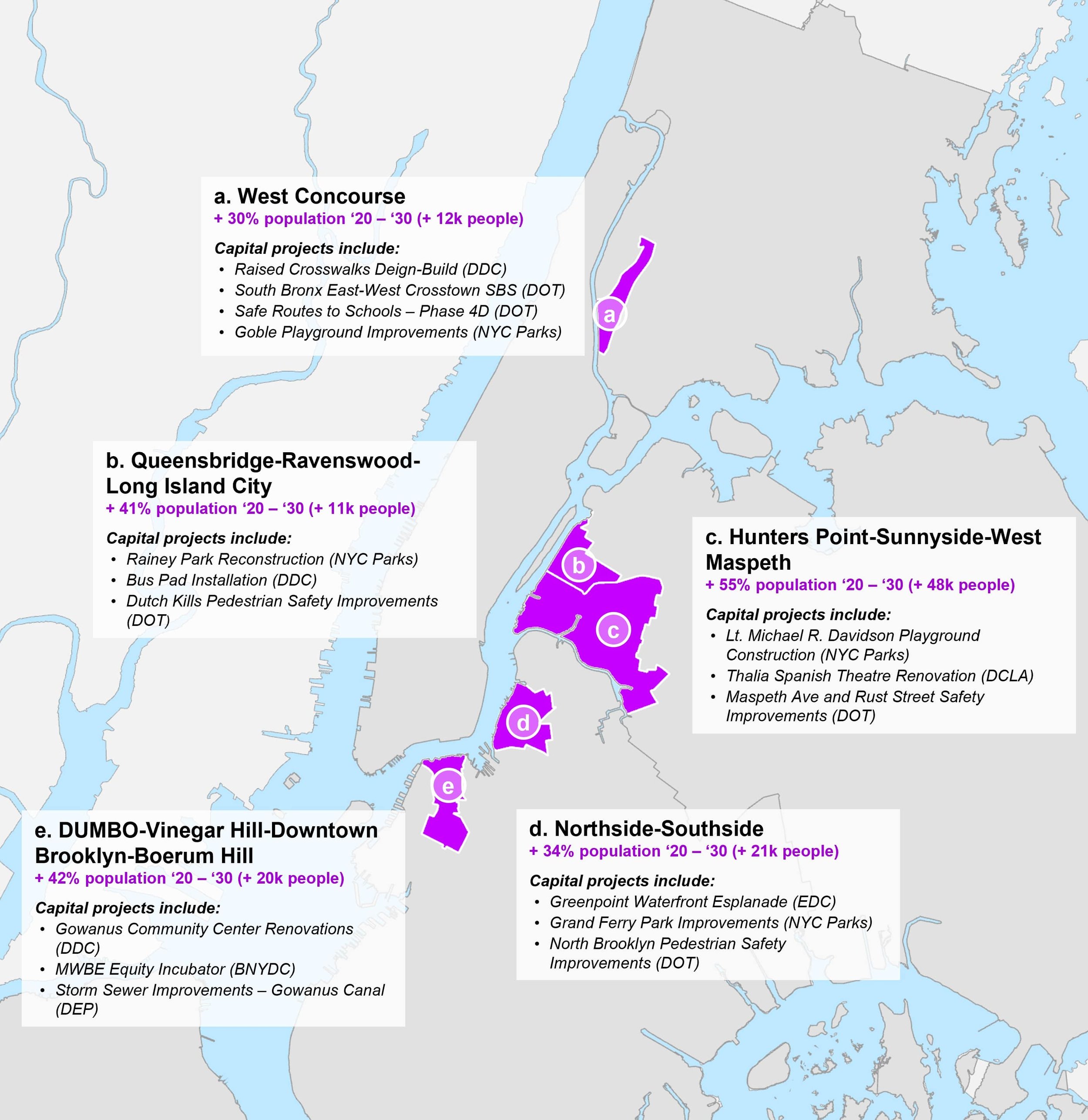

Population Growth and Capital Investment in Neighborhoods

According to DCP’s latest local population projections, the five neighborhoods with the greatest expected population change from 2020 to 2030 are Long Island City (boxes b and c), Downtown Brooklyn (box e), parts of Greenpoint and Williamsburg (box d), and West Concourse (box a). Each of these areas is expected to experience a greater than 30% increase in population over the next decade.

The City has major projects planned in anticipation of this growth, such as expanded sewers, new libraries, upgraded transit and streets, and improved open space. A selection of these growth-supporting investments from the City’s latest Capital Commitment Plan is provided for each neighborhood.

Select capital investments in neighborhoods with highest rates of projected population growth, FY 2020-30

- Source: Adjusted 2010 Census, NYMTC 2055 SED Forecasts (Jan 2020), and DCP Population Division

Planning for changes in housing

Housing growth is an important catalyst for capital projects. As a city, we closely monitor anticipated housing development to ensure our residential capital investments - such as schools, sewers, and parks - can accommodate anticipated housing changes at the neighborhood level. Our planned neighborhood-wide rezonings are conducted in coordination with city agencies with the goal of anticipated residential housing growth being supported with capital investments.

Between 2010 and 2021, New York City has seen a net increase of 251,000 housing units. Net increases in units have been concentrated in both transit-accessible neighborhoods and formerly non-residential areas that were rezoned to allow residential construction. In these transit-accessible neighborhoods, we are making targeted improvements to transit stations and area transportation options. In formerly non-residential areas, we are investing in schools, libraries, and open spaces to address the new needs of a residential population.

The COVID-19 pandemic and the associated temporary construction pause resulted in a short-term slowdown in housing production. In 2020, housing completions were down 19% and construction permits were down 28% compared to 2019. 2021 saw increases in both completions and permitting as construction returned to a more normal state. The first half of 2022, however, saw a massive increase in new housing permits in an effort by developers to vest under the expiring 421-a property tax exemption program. Despite 2022 representing a new peak in housing permits, it is unclear how many of these projects will be completed due to financing complications and the necessary construction timelines. Still, the high number of active permits for new buildings is enough to support our planning for high levels of continued housing production over the next 10 years, even before considering additional new permits that will be issued.

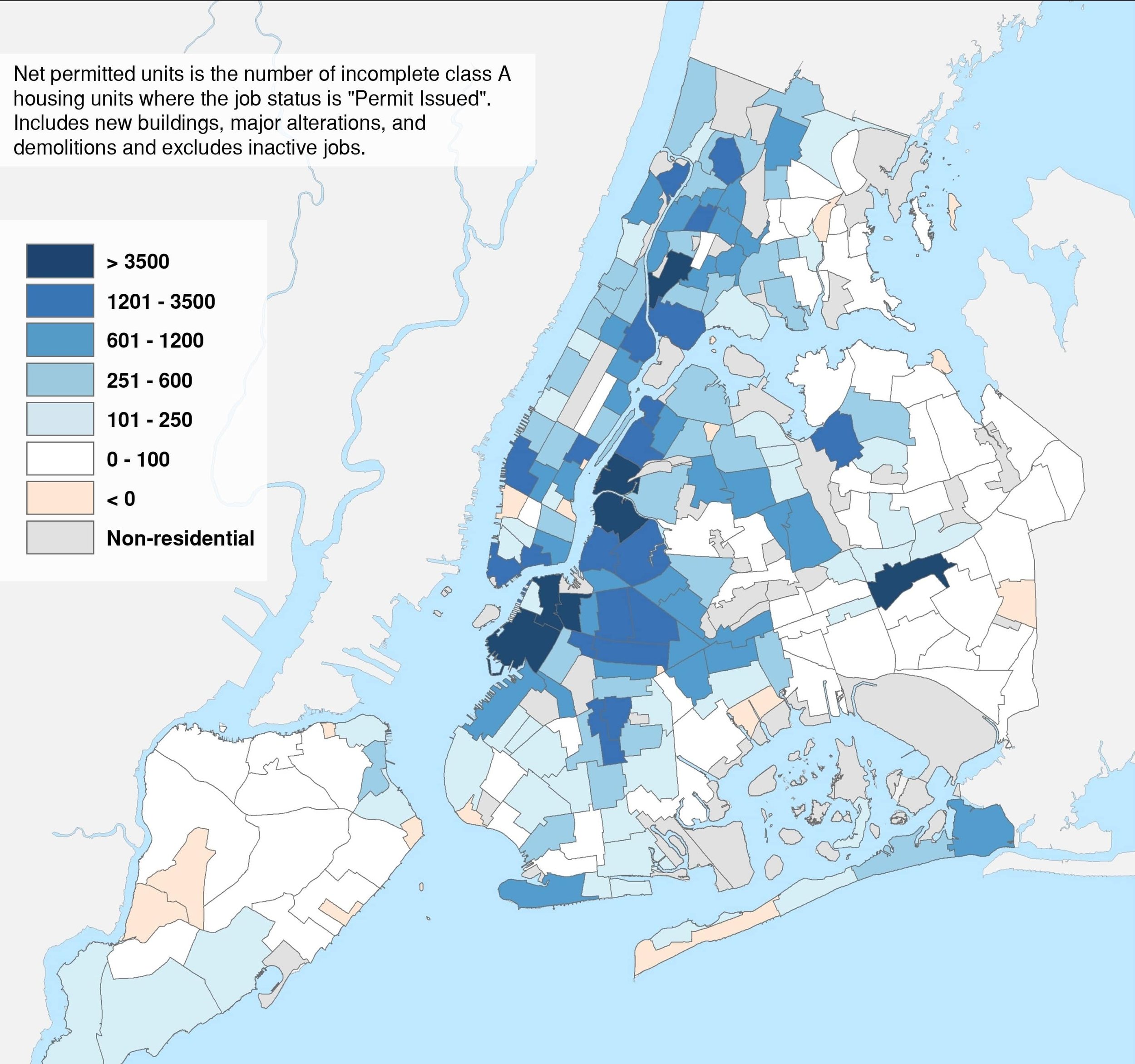

Housing Database

DCP’s Housing Database is an important public resource for understanding recent and near-term housing changes. The database captures DOB information on all permitted new buildings, demolitions, and alterations containing housing units since 2010. City agencies use this data to approximate the magnitude and location of changes in the housing pipeline, helping them plan for future, not just current, demand. The Housing Database is updated twice per year. DCP produces an accompanying Housing Production Snapshot with summary analyses revealing trends in the City’s housing production. A recent analysis showed almost 120,000 new units in the housing pipeline (active permits for new buildings as of June 30, 2022) with the largest share of new units expected in Brooklyn and Queens.

Net Permitted Housing Units map

- Source: DCP Housing Database v2022Q2, 2018 Neighborhood Tabulation Areas (NTAs)

Planning for changes in job trends

We analyze employment and other data to understand how the City’s economy is evolving. This helps us plan for capital investments that support businesses thriving and expanding in New York City. The City provides capital investments in critical commercial areas by investing in transportation, street improvements, and other infrastructure that supports business operations, especially in locations with growth potential, and catalytic assets like public space, public facilities, and affordable housing.

At its pre-pandemic peak, New York City was home to 4.5 million jobs. Between 2010 and 2019, New York City saw an increase of nearly 902,000 jobs. This job growth has been broadly distributed throughout the boroughs and has increased most rapidly in areas outside of Manhattan. Our investments in response to this growth have also been geographically broad. We are improving access to jobs through improved transportation connections, such as buses and ferries, opening workforce centers across the five boroughs and virtually, and making investments in commercial hubs.

Since the COVID-19 pandemic, the City has experienced a dramatic shift in employment and the nature of work. While the City has nearly recovered the number of jobs lost during the pandemic, many office employees continue to work remotely for part of the week. While the City continues to serve as an important headquarters location for office-based businesses, the complementary ecosystem of economic activity – like food and beverage, and other local services – have experienced a slower recovery in areas that were dependent on daytime office worker populations. On the reverse side, however, we have seen an influx of economic activity throughout the City’s residential neighborhoods, with remote workers spending more money closer to home.

The long-term impacts of the pandemic on job growth and location are still emerging. As these trends become clearer, the City is being guided by the recommendations of the “New” New York Panel convened by Mayor Adams and Governor Hochul to envision an equitable economic recovery and resurgence— reimagining how and where people work, optimizing the mix and use of space in key employment centers to minimize vacancy, catalyze vibrancy, bolster the tax base, and create new opportunities for New Yorkers to thrive in family-sustaining jobs.

For more detail on how our capital work catalyzes economic recovery, see Investment Priority 3.

Planning for climate change

The City has set an ambitious goal to reach carbon neutrality by 2050. As a result, we are modernizing zoning regulations to support decarbonizing our energy grid, building stock, vehicles, and waste streams. These changes will clear the path for much- needed green investments in a renewable energy grid, building construction and renovation methods, electrical vehicle charging stations, and landfill waste and stormwater processing reduction.

The City continues to design capital projects to standards that minimize our greenhouse gas emissions and maximize the resiliency and capacity of city infrastructure to respond to climate hazards. We are committed to responding to our changing climate through major energy efficiency improvements to government facilities, new coastal protections, tree-planting, cooling strategies to mitigate urban heat islands, and green infrastructure to mitigate the impacts of heavy rainfall.

See Guiding Principle 3 for detail on our climate-related investments.

Coordinating integrated capital investments for neighborhoods

We address neighborhood capital needs holistically through interagency collaboration. City agencies lead neighborhood- based plans to support growth, drive equity and economic development, facilitate accessibility, protect health and safety, and make other quality-of-life improvements. By working together, agencies can improve capital project prioritization and sequencing, and implement a more collaborative approach to community engagement.

For example, the City is taking a coordinated approach to redeveloping the old Naval Homeport on the North Shore of Staten Island. The New Stapleton Waterfront is an EDC-led initiative focused on providing transit-adjacent, public waterfront open space, shoreline resiliency, improved bicycle and pedestrian facilities, mixed-use development, affordable housing, and a new public school. Many capital agencies, including DEP, HPD, NYC Parks, DOT, and SCA, are coordinating to ensure an integrated approach to the 36-acre site that will connect with and complement the surrounding neighborhood.

Community-driven Capital Investments in The Gowanus Neighborhood Plan

The Gowanus Neighborhood Plan represents a long-term, shared vision for an equitable, inclusive, resilient, and sustainable neighborhood that complements the ongoing clean-up of the Gowanus Canal. In 2016, the City kicked off a study engagement process, which included topic-based working groups, larger public meetings, and an online engagement pilot that received over 17,000 visitors and more than 250 comments.

Following nearly a decade of engagement with community groups and elected officials, the final plan supports approximately 8,500 new homes, including 3,000 permanently affordable homes, as well as space for thousands of new jobs. The plan also provides tools to create a continuous publicly accessible waterfront esplanade across the Canal, bolster job growth and a mix of uses, and encourage new schools and transit improvements.

The plan includes $250 million in supporting investments for new and improved public parks, upgraded drainage infrastructure, and other community amenities and public realm improvements. An additional $200 million addresses priority capital improvements in the Wyckoff Gardens and Gowanus Houses NYCHA developments. The City is committed to continued coordination and accountability on the implementation of the plan alongside the Community Board and local stakeholders and in coordination with the newly formed Gowanus Oversight Task Force.

Gowanus Canal Bridge Crossing rendering

- Source: DCP